How Nigerian business owners will save millions in 2026 (without becoming Tax experts)

Tobi Omoyeni

Jan 15, 2026

It’s 6:47 PM in Lagos, Nigeria

Amaka stares at her laptop screen, triple-checking the numbers that don't add up.

Her e-commerce platform made ₦6.2 million last month, her best quarter yet. But instead of celebrating, she's panicking about whether her accountant calculated the right VAT rate, if she's set aside enough for Company Income Tax, and why her bank balance looks healthy, but she's terrified to spend anything.

She's not avoiding taxes. She's drowning in complexity.

If this sounds familiar, what I'm about to share could save your business hundreds of thousands, potentially millions of Naira this year.

The tax problem that's quietly killing Nigerian businesses

Let's be honest about what's really happening. Nigerian business owners face one of the most complex tax environments on the continent:

60+ different taxes across federal, state, and local levels

Multiple regulators with overlapping (and sometimes contradictory) requirements

Compliance costs are eating 15-20% of SME revenues

Penalties that compound faster than most startups grow

But here's what nobody talks about: The real killer isn't just the time. It's the cash flow impact.

When you're scrambling to find funds for tax remittance at the last minute, or when you're hit with penalties because you missed a filing deadline, you're not just losing money; you're losing your competitive edge. That's capital you could have invested in product development, market expansion, or talent acquisition.

A 2024 FIRS (now NRS) report revealed that over 40% of Nigerian businesses incur avoidable penalties annually, not from tax evasion, but from simple timing errors and miscalculations.

That's not a character problem. That's a system problem.

Why 2026 changes everything

The Nigerian government's new tax reform, now in effect, introduces several business-friendly provisions specifically designed to stimulate economic growth and simplify compliance.

Key changes that directly impact your bottom line

Reduced corporate income tax (CIT) rates for SMEs

Small Companies with annual turnover below ₦100 million: 0% CIT (previously 0% capped @ 50 million turnover for small companies)

Any other company above ₦100M: 30% CIT- Provided that the rate stated shall be reduced to 25% effective from a date as may be determined in an order issued by the President on the advice of the National Economic Council (NEC)

Simplified VAT system

While VAT rate remains at 7.5%, all input tax (including on fixed assets, overheads and services) can be recovered from output tax.

Legal framework for fiscalisation and e-invoicing introduced

VAT refund within 30 days of application without prior audit

Small Business (turnover ₦100m or less, relieved of VAT obligations)

Enhanced deductions and allowances

0% Tax rate on the first ₦800,000 of the annual income of individuals

0-25% progressive scale, individuals taxed on a sliding scale, low-income earners will pay less income tax. High-net worth individuals paying 1% more.

₦500K rent relief, an introduction of a significant rent relief amount.

The national minimum wage is exempt from tax.

Compliance simplification

Single tax identification number across all jurisdictions

Consolidated monthly remittance system (one payment portal for multiple taxes)

Economic Development Tax Incentives (EDTI)

Extension of incentives for up to five additional years where 100% of profits are reinvested. Addition of new priority products under existing certificates

Enhancement of foreign direct investment inflows and investor confidence

Encouragement of profit reinvestment and expansion of productive capacity

Targeted and flexible incentive framework that protects fiscal sustainability

Let me show you this in real numbers

Take a typical SaaS company with ₦80M annual revenue:

Before 2026 Reform:

Revenue Threshold (Medium-sized company): ₦95,000,000

Cost of sales & Admin Expenses: ₦15,000,000

CIT @ 20%: ₦16,000,000

Other business compliance cost: ₦2,400,000

Total burden: ₦18,400,000

After 2026 Reform:

Revenue (Small-sized company: ₦80,000,000

Revenue Threshold (Small-sized company): ₦95,000,000

Cost of sales & Admin Expenses ₦15,000,000

CIT @ 0%: ₦0

Other business reduced compliance cost: ₦800,000

Total burden: ₦800,000

Annual savings: ₦17,600,000

That's a 96% reduction, money that goes straight into product development, hiring, or market expansion.

The trap: Why most businesses won't capture these savings

Here's the uncomfortable truth: knowing about tax savings and actually capturing them are two completely different things.

The 2026 reform creates enormous opportunities, but only for businesses with the infrastructure to:

Track all applicable taxes across their sector without confusion

Apply correct tax rates at the point of transaction (not retroactively)

Set aside funds proactively so remittance doesn't create cash flow crises

Remit on time, every time to avoid penalties that erase your savings

Maintain compliance without overhauling existing business processes

Most businesses are still operating with:

Manual calculations that introduce errors at every transaction

No systematic way to set aside tax funds (leading to "surprise" liabilities)

Missed deadlines because tracking obligations across multiple authorities is overwhelming

Cash flow chaos when large tax payments come due unexpectedly

Fear of audits because documentation is scattered or incomplete

The result?

You save money on paper but lose it in execution. You qualify for lower rates but pay penalties that wipe out the benefit. You have better tax laws, but the same compliance headaches.

The 4-part framework smart business owners are using

Here's how forward-thinking business owners are approaching the new tax landscape:

Step 1: Audit your position

Calculate potential savings under the new structure

Identify every applicable tax for your sector

Find gaps in current tax management processes

Determine your compliance risk level

Step 2: Build an infrastructure that works invisibly

Integrate tax management into existing workflows

Automate fund allocation as revenue arrives

Create systematic remittance (not crisis management)

Eliminate manual calculations

Step 3: Optimise at the transaction level

Apply correct rates as transactions happen

Monitor cash flow with taxes already accounted for

Stay current with regulatory changes

Maintain continuous compliance

Step 4: Scale without fear

Ensure tax management scales as you grow

Add obligations automatically when expanding

Build investor-ready financial reporting

Operate with total peace of mind

The winners in 2026 won't be the ones who know tax law best; they'll be the ones whose systems handle compliance automatically.

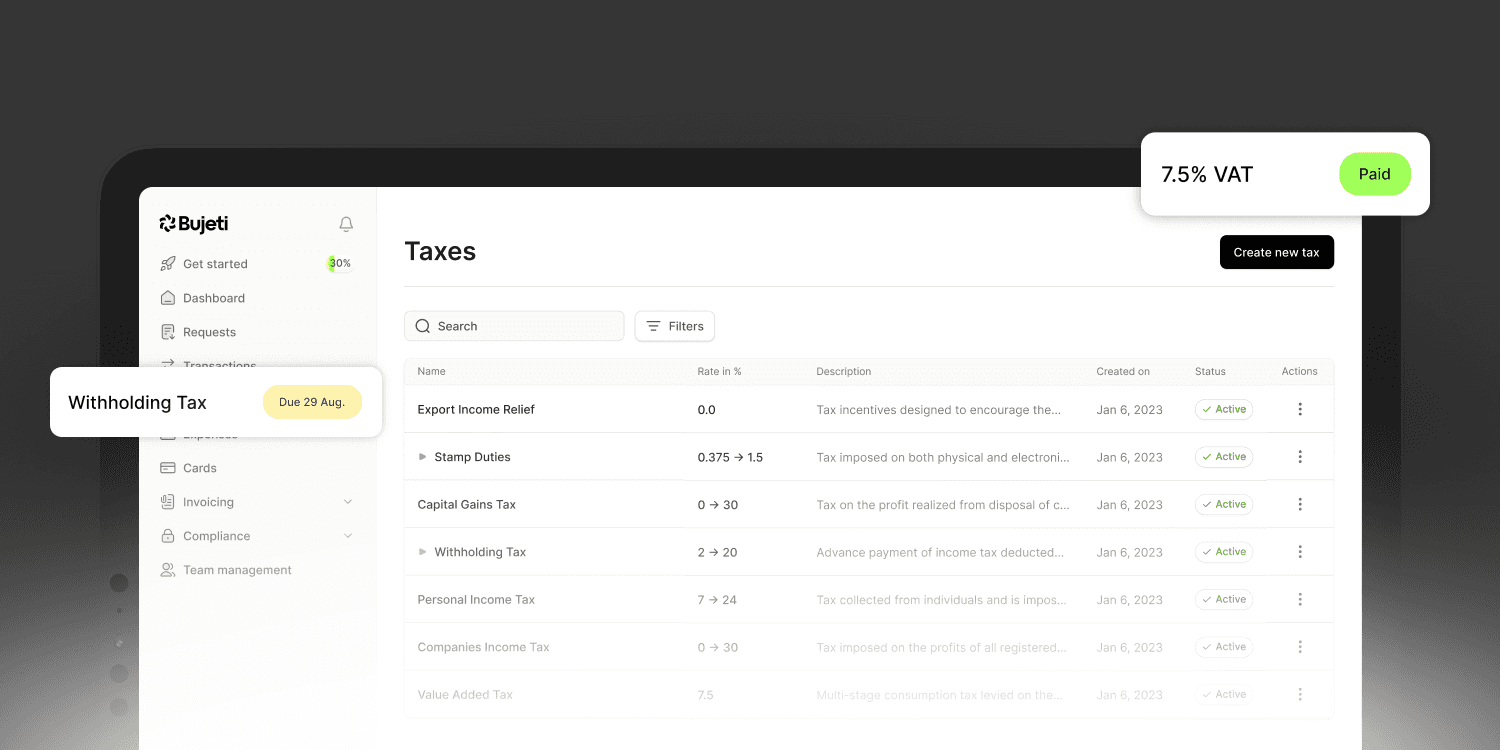

How Bujeti Tax Management turns complexity into a non-issue

This is where we get practical.

Most tax software asks you to change how you work. Bujeti Tax Management does the opposite; it adapts to your existing workflows and handles complexity in the background so you can focus on running your business.

Here's the simple truth: you shouldn't have to become a tax expert to benefit from tax reform. You just need the right system.

Here's how it works:

1. Configure once, apply everywhere

Set up all applicable taxes for your business, CIT, VAT, WHT, development levy, or any sector-specific obligation in one place. Whether you operate in fintech, e-commerce, professional services, or manufacturing, Bujeti lets you configure the exact tax structure that applies to your business.

No more guessing which taxes apply to which transactions. No more separate tracking systems. Just one centralised configuration that ensures accuracy across every transaction.

2. Apply taxes in one click

This is where Bujeti becomes invisible in the best possible way.

As transactions happen, whether you're processing customer payments, paying vendors, or running payroll, the correct taxes are applied automatically with a single click. The system knows which taxes apply based on your configuration and the transaction type.

Your team doesn't need to calculate anything. They don't need to remember which rate applies. They just process the transaction, and Bujeti handles the tax treatment correctly, every single time.

This means:

No manual calculations that introduce errors

No scrambling at month-end to figure out tax obligations

No "did we apply VAT to this?" conversations

Complete confidence that every transaction is tax-compliant from the moment it happens

3. Dedicated Tax Vault: Set it aside before you spend it

Here's where most businesses get into trouble: they see revenue come in, they spend it on operations, and then when tax remittance is due, they're scrambling to find the funds.

Bujeti solves this with a dedicated Tax Vault that automatically sets aside the exact amount you owe as transactions occur.

Think of it as paying yourself first except you're paying your tax obligations first. As money flows through your business, the tax portion is automatically allocated to your Tax Vault. It's there, it's accounted for, and it's not getting accidentally spent on anything else.

This transforms your cash flow management:

Zero-surprise tax bills that create liquidity crises

Always know exactly how much is available for business operations (because tax obligations are already set aside)

Sleep soundly knowing you're not spending money you'll owe FIRS next month

Build a track record of consistent, on-time remittance

4. Remit accurately and on time with complete confidence

When remittance dates arrive, you're not scrambling. The funds are already in your Tax Vault. The calculations are already done. The documentation is already in place.

Remit directly through Bujeti with complete accuracy, on time, every time. The system ensures you're paying exactly what you owe no more, no less with the peace of mind that comes from knowing your compliance is airtight.

No more:

Late-night panic about whether you calculated correctly

Penalties for missed deadlines or incorrect amounts

Manual reconciliation between what you think you owe and what you actually owe

Anxiety about potential audits because your records are scattered

The Bujeti difference: compliance without disruption

What makes Bujeti Tax Management different isn't just what it does, it's what it doesn't make you do.

You don't change your accounting system. You don't retrain your entire team. You don't alter your business workflows. You don't become a tax expert. You configure your taxes once, and Bujeti works silently in the background, ensuring every transaction is compliant, every obligation is funded, and every remittance is on time.

It's tax management that actually manages taxes, so you don't have to.

Real-world application:

Consider TechNova, a Lagos-based software development company with 25 employees and ₦120 million in annual revenue.

Before Bujeti:

Tax calculations done manually at month-end (consuming 15+ hours per week)

Frequent errors in applying the correct VAT rate to different service types

Regular cash flow stress when tax payments came due

Paid ₦800K in penalties over 18 months due to timing errors and miscalculations

Tax liability: ₦24M annually

After Bujeti (First year with 2026 reform):

Taxes are configured once for all applicable obligations

Tax application happens automatically in one click during invoicing

Tax Vault ensures funds are always available when needed

Tax compliance: 3 hours per week (80% reduction)

Zero penalties (automated compliance and accurate calculations)

Captured 100% of available savings under the new reform

Tax liability: ₦11.2M annually

Total value captured: ₦13.6M in the first year

But the real value wasn't just the money saved. It was the peace of mind. TechNova's founders no longer spend weekends worrying about tax deadlines or whether they've calculated correctly. Their finance team focuses on strategic work instead of manual calculations. And they have complete confidence that as they scale, their tax compliance scales with them—automatically.

The opportunity cost of waiting

Here's what's at stake:

Every month you operate without streamlined tax management, you're potentially:

Miscalculating tax obligations and either overpaying or underpaying (both are expensive)

Creating cash flow volatility because you don't have systematic fund allocation

Accumulating compliance risk that could trigger penalties

Wasting valuable team time on manual processes that could be automated

Missing the full savings available under the 2026 reform

The 2026 reform isn't coming; it's here. The early movers are already capturing savings while competitors scramble to understand the implications.

The question isn't whether you can afford to optimise your tax management. It's whether you can afford not to.

Your next move

The tax landscape in Nigeria just shifted in your favour. But opportunity without execution is just trivia.

If you're serious about:

Capturing every naira of savings available under the new reform

Eliminating tax-related cash flow stress and last-minute scrambling

Achieving consistent, penalty-free compliance without changing how you work

Spending your time building your business instead of calculating tax obligations

Then it's time to see Bujeti Tax Management in action.

Option 1: Calculate your savings

See exactly how much you could save under the 2026 reforms and how Bujeti works within your operations.

Option 2: Watch a live demo

See how Bujeti configures taxes, applies them in one click, sets aside funds automatically, and enables stress-free remittance.

Option 3: Start free trial

Experience the platform firsthand. Set up your configuration, process transactions, and see your Tax Vault in action.

Start Your 14-Day Free Trial (No credit card required)

The Nigerian business environment just became significantly more favorable for companies with the right infrastructure. Make sure you're one of them.

Because in 2026, the winners won't be the businesses that understand tax reform best—they'll be the ones whose systems handle it automatically.