When spreadsheets stop scaling with your business

Abdurrauf - Data Engineer

February 17, 2026

Most businesses don't start with broken systems. They start with spreadsheets.

It begins innocently enough. A founder opens Excel on a Tuesday afternoon to track the first few customer payments. Maybe it's a simple list: date, customer name, amount, status. Clean. Manageable. Exactly what's needed.

A few weeks later, they added another sheet for expenses. Then one for projections. Before long, there's a file called "Finance_Master_v2" sitting in a shared drive, and it's doing its job perfectly well.

Excel files. Google Sheets. Shared folders. In the early days, this worked. It's fast, familiar, and flexible. You can track expenses, reconcile payments, and answer basic questions without much overhead. For a while, spreadsheets feel like enough.

Until they aren't.

Why spreadsheets work at first

Picture a startup with three employees. The founder handles the books. The operations manager checks in occasionally. Everyone works from the same file, updated at the end of each week. There are maybe twenty transactions a month. When something looks off, a quick Slack message clears it up.

There's a reason nearly every business begins this way. Spreadsheets are genuinely effective when one or two people manage the data, processes are simple and informal, the volume of transactions is small, and everyone trusts the same file.

At this stage, spreadsheets are not a mistake. They're a practical choice. You don't need enterprise software when you're processing a handful of invoices and everyone sits in the same room.

The problem isn't that teams start with spreadsheets. The problem is what happens as the business grows.

The quiet breaking point

Fast forward eighteen months. The team is now fifteen people. There are three departments. Monthly transactions have gone from twenty to two hundred. The finance person who used to manage everything solo now has a junior colleague. Investors are asking questions. Auditors want documentation.

As operations expand, a few things start to change. More people need access to the same data. Approvals and reviews become necessary. Timelines get tighter. Someone in sales needs budget numbers by the end of day. The CEO wants to understand burn rate trends before the board meeting. Decisions carry more financial weight.

This is where cracks begin to show.

It starts small. Someone in operations downloads a copy of the master sheet "just to adjust something" for their department review. They forget to mention it. Meanwhile, finance updates the original with new vendor payments. Now there are two versions, slightly different, both called "Finance_Master_Q2."

A week later, another person updates a number without adding context—was that figure a projection or an actual? Did it include the new contract or not? No one's quite sure anymore.

Reconciliations that used to take thirty minutes now consume half a day. Different reports show different totals because they're pulling from different versions of the same underlying data. The Monday morning finance meeting turns into a detective session: which file has the right numbers?

You start hearing phrases echo around the office: "This was correct yesterday." "Wait, use my version, not that one." "Let's just reconcile everything again and get back to it."

Progress slows, not because the business is failing, but because the system underneath it isn't designed for scale. Your finance person spends more time tracking down discrepancies than analysing what the numbers actually mean.

The real issue isn't the spreadsheet

Here's the thing: spreadsheets don't fail because they're bad tools. Excel is powerful. Google Sheets is incredibly useful. They've been the backbone of business operations for decades, and for good reason.

They fail because they were never designed to provide what a growing business actually needs: a single source of truth, consistent definitions across teams, controlled access and accountability, or reliable history and auditability.

Think about how a spreadsheet actually works. In one cell, you have raw data. In the next, a formula. Three tabs over, a pivot table summarising everything. The chart on the dashboard pulls from last week's numbers because someone forgot to update the reference. One person's "revenue" includes pending invoices; another's doesn't.

In other words, spreadsheets mix data, logic, and reporting in one place. That works when the stakes are low and only one person needs to understand the file. It becomes risky—sometimes dangerously so—when the business grows.

A CFO at a Series A startup once told us she discovered three different spreadsheets being used to calculate the same metric. Each had slightly different assumptions. Each produced slightly different results. None were technically wrong, but none were completely right either. "We were making million-dollar decisions," she said, "based on numbers we couldn't fully trust."

Scaling requires structure, not just more effort

When businesses hit this stage, the instinct is often to "be more careful." Teams implement new protocols: double-check all numbers, add more manual reviews, create more validation sheets, have multiple people sign off before sharing anything externally.

Everyone works harder. People stay later. The finance team builds elaborate version control systems with file names like "Finance_Master_Q2_FINAL_v3_ACTUAL_USE_THIS_ONE.xlsx."

But effort doesn't fix structural problems. You can't work-around your way out of a system that wasn't built for what you're asking it to do.

What growing teams actually need is fundamentally different: centralised data that lives in one place, not scattered across dozens of file versions; clearly defined processes where everyone follows the same steps in the same order; consistent rules for how numbers are calculated, applied uniformly regardless of who's doing the work; and visibility that doesn't depend on who prepared the file or whether you're looking at the right version.

This is less about tools, and more about how financial data is organised and controlled.

From files to systems

At scale, finance teams need systems that do four critical things.

First, they need to capture data once and make it reusable. When a payment comes in, it should be recorded one time, in one place, and then available to everyone who needs it, or reporting, for reconciliation, for forecasting, without being copied, pasted, or re-entered.

Second, they need to preserve history instead of overwriting it. In a spreadsheet, when you change a number, the old number is gone. You can't see what it was before, who changed it, or why. In a proper system, every change leaves a trail. You can see exactly what happened and when.

Third, they need to support approvals and accountability. Who authorised this spend? Who reviewed this reconciliation? Who signed off on these numbers before they went to the board? These questions should have clear, auditable answers.

Fourth, they need to produce consistent answers, regardless of who asks the question. When the CEO asks about monthly burn rate and the CFO asks about monthly burn rate, they should get the exact same number, calculated the exact same way, from the exact same source.

This is the point where businesses naturally move beyond spreadsheets, not because spreadsheets are wrong, but because the business has outgrown them.

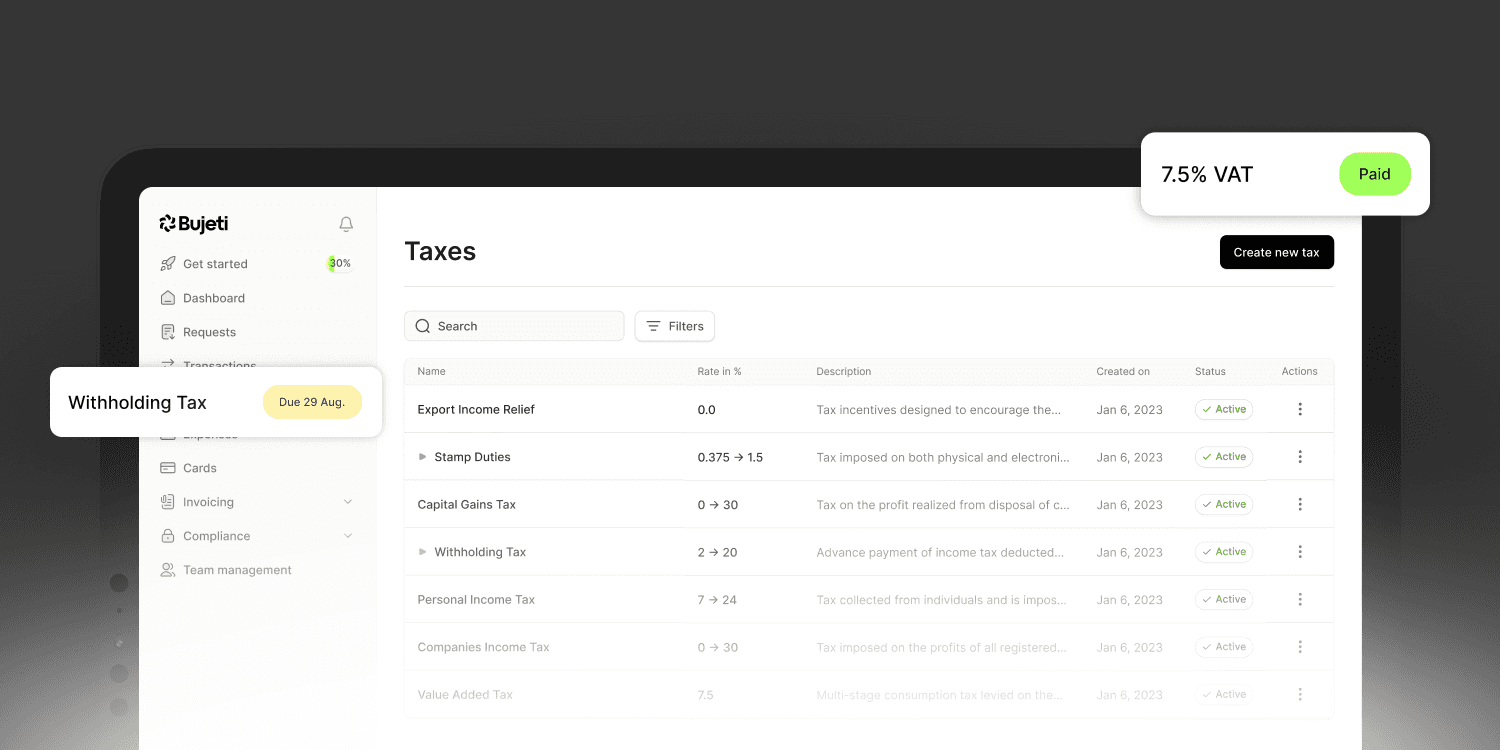

Bujeti is built around this transition. We've worked with dozens of finance teams making this shift, and we've seen the same pattern repeat: there's a moment when the old way stops working, when the effort required to maintain spreadsheet-based processes exceeds the effort of implementing something more structured.

We help teams move from scattered files to structured, reliable financial systems that can support growth. The goal isn't complexity for its own sake. It's control, clarity, and confidence. It's knowing that when you pull a report, the numbers are right. When you make a decision, you're working from accurate information. When you scale from fifteen people to fifty to two hundred, your financial infrastructure scales with you.

Scaling without losing visibility

Here's what the transition looks like in practice.

A fintech company came to us when they hit seventy employees. Their Head of Finance was drowning. She had ten different spreadsheets tracking different aspects of the business: vendor payments, customer invoicing, departmental budgets, cash flow projections, commission calculations. Each fed into a master consolidation sheet that took two full days to update every month.

"I was spending 40% of my time just making sure the numbers matched," she told us. "And I still wasn't confident in them."

Six months after implementing Bujeti, her team had cut their monthly close process from twelve days to four. Reconciliations that used to take hours now took minutes. Department heads could see their budgets in real-time without requesting custom reports. The CEO had a dashboard that always showed current numbers, not figures from two weeks ago.

Most importantly, she told us, "I went from being a spreadsheet manager to actually doing finance. I analyse trends now. I model scenarios. I help make strategic decisions. The system handles the data; I handle the insights."

Growing businesses don't just need faster processes. They need trustworthy ones.

When financial data is structured properly, teams spend less time reconciling and more time analysing. Leaders make decisions faster because they're not waiting days for someone to pull together a report. Reporting becomes consistent because everyone's working from the same definitions and the same data. Growth stops feeling chaotic because you have systems that can handle the complexity.

Spreadsheets can be the starting point. But sustainable growth requires systems designed to scale with the business.

A final note

This isn't an argument against spreadsheets. It's an argument for recognising when the business has moved beyond them.

There's no shame in starting simple. Every successful company we work with began with spreadsheets. The smartest ones recognised when it was time to evolve.

The earlier that transition is handled intentionally, the easier scaling becomes. Wait too long, and you're implementing new systems while fighting fires, migrating data while closing the quarter, training the team while managing an audit.

If your team is starting to feel the strain, if reconciliations are taking longer each month, if version control is becoming a recurring problem, if you're not completely sure which numbers to trust when making important decisions, it might be time to consider what comes next.

Bujeti is here to help you make that shift with confidence. Not because spreadsheets are bad, but because your business deserves financial infrastructure that grows with your ambition.

Get started today on Bujeti. Visit www.bujeti.com