We built tax management in four months. Here’s the story behind it

Titilayo Akinjogunla

February 11, 2026

If you're reading this, you've probably heard that Bujeti launched tax management. As always, I'm sharing the story behind how we built it.

When Nigeria signed the new Tax Act 2025 into law in June 2025, with an effective date of January 20, 2026, many businesses didn’t feel urgency. January felt far away with plenty of time.

Most businesses thought their spreadsheets would still work, and their accountants handled filing. Everything would be fine, or so they thought. At Bujeti, we saw it differently.

We knew the new act would change everything, from how taxes needed to be tracked and applied to how they needed to be filed. The fragmented systems that had worked before, including spreadsheets, were about to break.

Also, when penalties are imposed, they won’t be small, so reporting needs to be tightened.

In October 2025, we began building tax management directly into Bujeti.

We brought tax experts in early, before we shipped anything

A month in, it became obvious that building tax software without tax experts would be irresponsible. We engaged Tax Partners at Forvis Mazars and Rilwanu, a tax professional who works closely with growing businesses. We asked them to do two things:

Help us understand how the new law really works in practice, not just in theory.

Tell us if what we were building actually matched how tax compliance really works for real businesses.

Over November and December, they did exactly that, guiding us and challenging us.

In addition, we ran educational webinars. Each one revealed common threads:

“We withhold tax from contractors; do we need to track that separately now?

Our turnover is under ₦100m. We don’t pay CIT, but do we still need to file?”

Those questions weren’t edge cases. They were the reality for businesses scrambling to adapt.

Coin & Connect: The feedback session that further shaped the product

On the 16th of December, we hosted a premium mixer (Coin & Connect) for about 150 business and finance leaders.

We stood in front of the room and did something unusual: we did a live demo of what we’d built instead of fancy presentation slides.

We showed:

How to configure taxes once VAT, WHT, Entertainment Tax, CIT, etc

How to bundle taxes in a tax group and apply them in one click to invoice or vendor payments

How tax funds are separated into a Tax Vault so they aren’t spent accidentally

Then we asked the simple question: “What are we missing?”

We heard feedback that turned into features:

Feedback 1: “We operate in Nigeria and Kenya. How do I make sure my team applies the right tax for the right country?”

So we went back and tightened country-based tagging. When you’re applying taxes on an invoice, Bujeti displays only taxes valid for the currency you select. Your team can’t apply the wrong rate, even by accident.

Feedback 2: “Some of our products are VAT-exempt. How do we handle 0% VAT properly?”

That mattered. Under the VAT Act, VAT-exempt items include basic food items, medical and pharmaceutical products, educational services, and certain financial services. Charging VAT on them isn’t just wrong, it’s a compliance issue.

In the meantime, customers can create a zero-rated VAT, which can be applied to products in this category. Pending when we roll out our inventory management, where you can tied 0% VAT directly to product categories.

With that, you will be able to

Categorise products as VAT-exempt

Apply 0% VAT automatically

Prevent teams from accidentally charging VAT on exempt items

Feedback 3: This, for me, was the biggest feedback: “Where do I see everything I’ve collected and everything I’ve withheld, separately?”

To be honest, we had built transaction tracking directly into the Tax Vault; this tracks tax collected and withheld. But it led us into a rabbit hole of can these people even track taxes that they have applied (inclusive of pending and deducted)

So we built a tax application tracking page with distinct sections for where the tax was applied, tax amount, the date it was applied, among others, all in a clean format that can easily export

Every piece of feedback helps us further shape the product before we ship it out.

*Ship here means us launching it as a product ready to be used by our customers.

So what did we actually build?

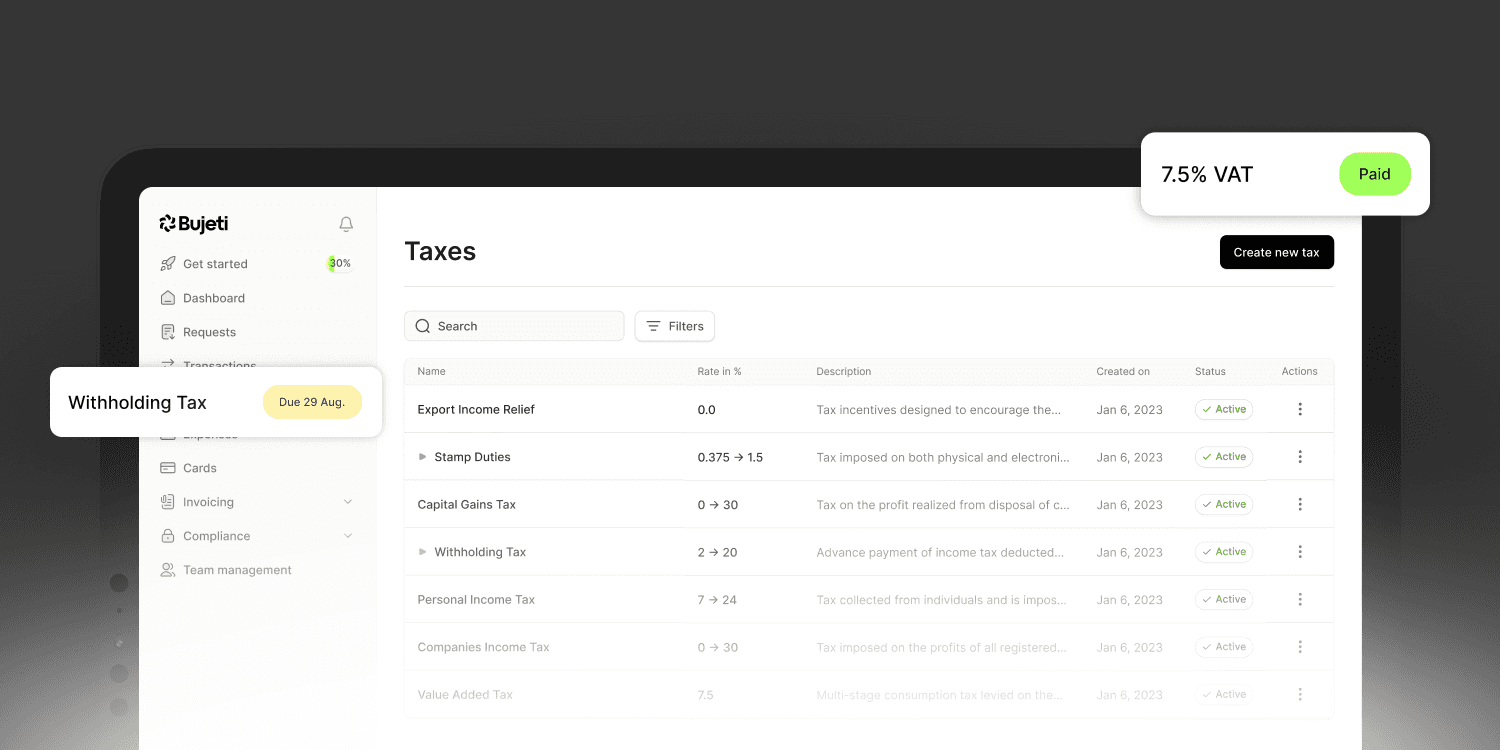

Here’s what Bujeti Tax Management looks like now:

1. Configure taxes once

Businesses handle multiple tax types across their different industries, so Bujeti lets you

With Bujeti, you:

Create every tax your business needs. (e.g., NG VAT 7.5%, NG WHT 5% or 10%, Entertainment Tax 5%, 0% VAT for exempt products)

Tag it with the relevant country, and, where needed, a product category. So when you create an invoice, only the correct

Next time you create an invoice or pay a supplier, Bujeti shows only the taxes that apply to the country based on the currency you've selected, so your team doesn’t have to guess or make a mistake.

2. Taxes apply where money already moves

We didn’t build a separate tax tool, as tax needs to be applied at the point of transaction, not reconstructed later. Meaning that Tax should live right where money already moves

So in Bujeti, you can apply taxes when:

Creating invoices

Paying suppliers

Managing inventory (Not live yet)

When you create an invoice, you select your customer, add line items, and choose the applicable tax or tax group. Bujeti calculates the amount, itemises it clearly on the invoice, and includes it in the total.

When you’re paying a vendor, you enter the amount and select the appropriate withholding tax. Bujeti deducts it automatically. Your vendor receives the net amount, and the withheld tax moves to your Tax Vault.

Everything stays in one place, so you’re not switching tools or working with spreadsheets on the side.

3. Tax Vault keeps tax money separate; this is critical now

This is one of the most important parts of what we built, which our tax expert further validated with this comment:

“The biggest compliance problem isn’t calculating tax. It’s when businesses mix tax money with operations, then spend it. By the time remittance is due, the money’s gone.”

Under the Tax Act 2025, penalties for late or incomplete remittance are much steeper.

So every time tax is applied in Bujeti:

Collected VAT goes into the Tax Vault

Withheld taxes go into the Tax Vault

Other taxes go into the Tax Vault

Your operating money stays in your operating account. Your tax money stays where it should, so when the monthly remittance comes, it's already there.

4. Track collected and withheld taxes

Rilwanu pushed this hard.

In the past, many businesses tracked only what they collected from customers, such as VAT. Withholding tax on suppliers was either ignored or buried. Under the new law, both matter.

We built and ensure we track both clearly: taxes collected (what you charge customers) and taxes withheld (what you deduct from vendors). Both feed your dedicated Tax Vault, and both appear in your reports.

When filing time comes, you don’t have to reconstruct what happened. You already have complete visibility, as required by law.

5. Clean records for filing, even if you’re exempt from paying CIT

Another misconception we kept hearing: 'Our turnover is under ₦100m. We don't pay CIT. We don't need to file.' Wrong.

If your company is an LTD with an annual turnover of ₦100 million or less, you’re classified as a small company. Yes, your CIT rate is 0%, but filing is still mandatory.

Bujeti doesn’t assume tax equals payment; we put tax compliance under your control

So whether you owe tax or not, you still get:

Clean records

Exportable reports

Documentation for you to file with confidence

Support beyond software

We were deliberate about what Bujeti Tax Management does and how we support you. We know tax compliance isn't one-size-fits-all. Every business has its own realities: industry-specific rules, exemptions, and edge cases, especially under the new Tax Act.

That's why we didn't stop at building software.

Alongside a platform that puts day-to-day compliance in your control, we provide access to human tax experts who offer guidance when things get complicated, helping you understand how the law applies to your business, what you're required to file, and how to approach remittance under the new rules.

Our goal isn't to replace your accountant or blindly automate everything. It's to remove the chaos that occurs before filing and to give you clarity when decisions need to be made.

With Bujeti Tax Management, compliance stays embedded in how you operate. Support is there when you need context, guidance, or reassurance.

Who this is for

You’re operating under Nigeria’s Tax Act 2025, and spreadsheets aren’t holding up.

You operate in multiple countries and need the right tax applied every time.

You’re worried about spending tax funds before remittance.

Your accountant wants a clear separation between collected and withheld taxes.

You want compliance to stop feeling like a second job.

How to get started

If you’re already using Bujeti:

Go to Taxes

Click Create Tax to create new taxes or see the default added taxes

Apply the applicable taxes to your invoice, bill payments, and other transactions

If you’re not on Bujeti yet, book a demo at bujeti.com/contact