The hidden costs of unmanaged expenses: Why every cent counts

Tracy-Allen

June 20, 2025

Benjamin Franklin once said, “Beware of little expenses. A small leak will sink a great ship.” Over two centuries later, this timeless wisdom still rings true, especially for today’s businesses navigating financial challenges in a competitive market.

Poor expense management may seem minor at first, but over time, it can quietly clear your profits, hinder growth, and expose your business to compliance risks. In this article, we’ll explore the ripple effects of unmanaged expenses, and how businesses like yours can regain control before the damage is done.

The ripple effect of unmanaged expenses

Untracked expenses don’t just disappear; they pile up. When left unchecked, even small financial leaks can trigger significant challenges:

1. Budget overruns and overspending

One of the most immediate consequences of unmanaged expenses is overspending. Without a structured system to monitor cash flow, your business could risk exceeding its budgets—allocating funds to non-essential items while starving key operational areas.

A well-defined budget is your first line of defense. It requires more than just numbers on a spreadsheet; it involves real-time tracking, categorization, and regular analysis. With a solution like Bujeti, businesses like yours can gain immediate visibility into their spending patterns and adjust quickly before things spiral out of control.

2. Inefficient resource allocation

When you don’t know where your money is going, it becomes nearly impossible to allocate resources efficiently. Departments may overspend on duplicate services, and valuable capital could be tied up in low-impact expenses.

Smart financial tools like Bujeti help businesses see the full picture like categorizing spend, flagging inefficiencies, and generating insights that empower better decisions. The result? Optimized allocation of funds and a more productive, profitable operation.

3. Financial reporting risks

Accurate financial reporting is the backbone of good business decisions—and regulatory compliance. But unmanaged expenses can lead to disorganized records and unreliable reports, setting off a chain of avoidable risks.

Compliance and Tax Penalties

Improper expense documentation increases the risk of errors during tax filing. Inconsistent records can trigger audits or attract penalties from tax authorities.

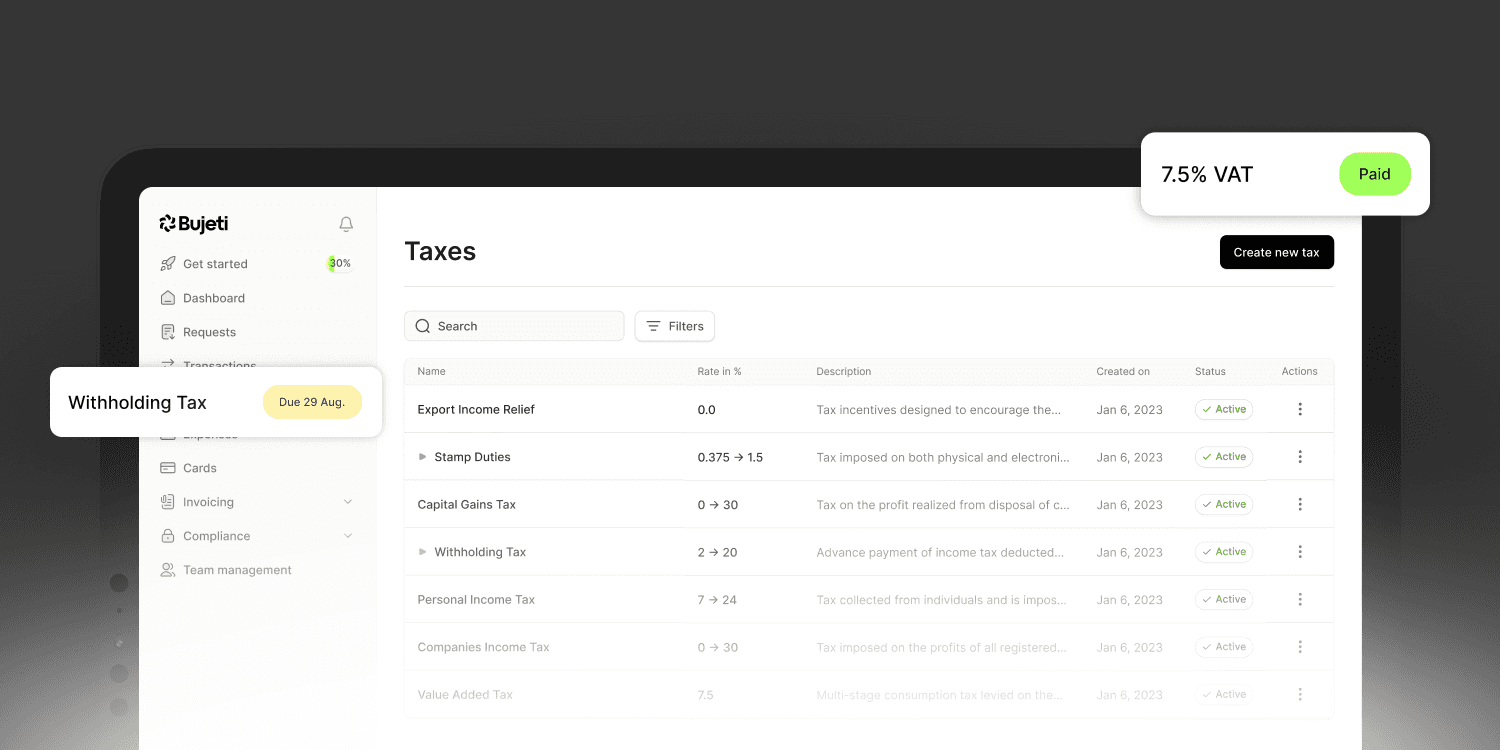

A digital expense management solution like Bujeti ensures every transaction is accounted for, categorized, and backed by receipts—keeping your business compliant and audit-ready.

Impaired Financial Analysis

If your financial data is incomplete or inaccurate, your insights will be too. Strategic decisions become guesswork, and that uncertainty can hurt everything from budgeting to investment planning.

Bujeti offers detailed reports, visual dashboards, and real-time tracking that helps you understand your financial health clearly—and act confidently.

Best practices for avoiding hidden costs

Avoiding the pitfalls of unmanaged expenses isn’t complicated, but it does require consistency and the right tools. Here’s where to start:

1. Use a centralized expense management solution

A unified platform like Bujeti simplifies expense tracking and streamlines approvals. With features like, real-time syncing, and customizable dashboards, you’ll spend less time managing expenses and more time managing growth.

2. Build and monitor realistic budgets

Effective budgeting starts with accurate data. Use expense records from previous months to inform future budgets. Then, monitor your actual spending against those forecasts regularly. Bujeti makes this process effortless by providing real-time comparisons and alerts when your spending exceeds thresholds.

3. Encourage transparency across teams

In organisations, expense management isn’t a one-person task. Foster a culture of accountability by encouraging teams to report expenses promptly and accurately. Clear communication, paired with easy-to-use solutions, ensures better reporting and financial discipline.

4. Conduct regular expense reviews

A quarterly or monthly audit of your business expenses can uncover inefficiencies you didn’t know existed. Review subscriptions, vendor contracts, and spending trends. Solutions like Bujeti makes it easy to visualise spending patterns and identify opportunities for cost savings.

Final thoughts on unmanaged expenses

Unmanaged expenses may seem small, but their impact can be significant. From missed growth opportunities to costly compliance issues, the risks aren’t worth ignoring. By proactively managing your spending with smart solutions like Bujeti, you can protect your financial health, improve decision-making, and position your business for long-term success.

Start building a stronger financial foundation today. Explore how Bujeti can help at bujeti.com.