From compliance to workflow: Why we’re changing the game

Tracy-Allen

June 30, 2025

Rethinking compliance as a daily workflow

Let’s be honest, when most people hear “compliance,” they think paperwork, approvals, and maybe a little bit of policing. It feels like something you check off after the work is done. But that’s the problem.

In today’s fast-paced business world, waiting until the end of the month or quarter, just to clean things up is too late. By then, errors have already slipped through, rogue expenses are hard to trace, and decision-makers are stuck playing catch-up.

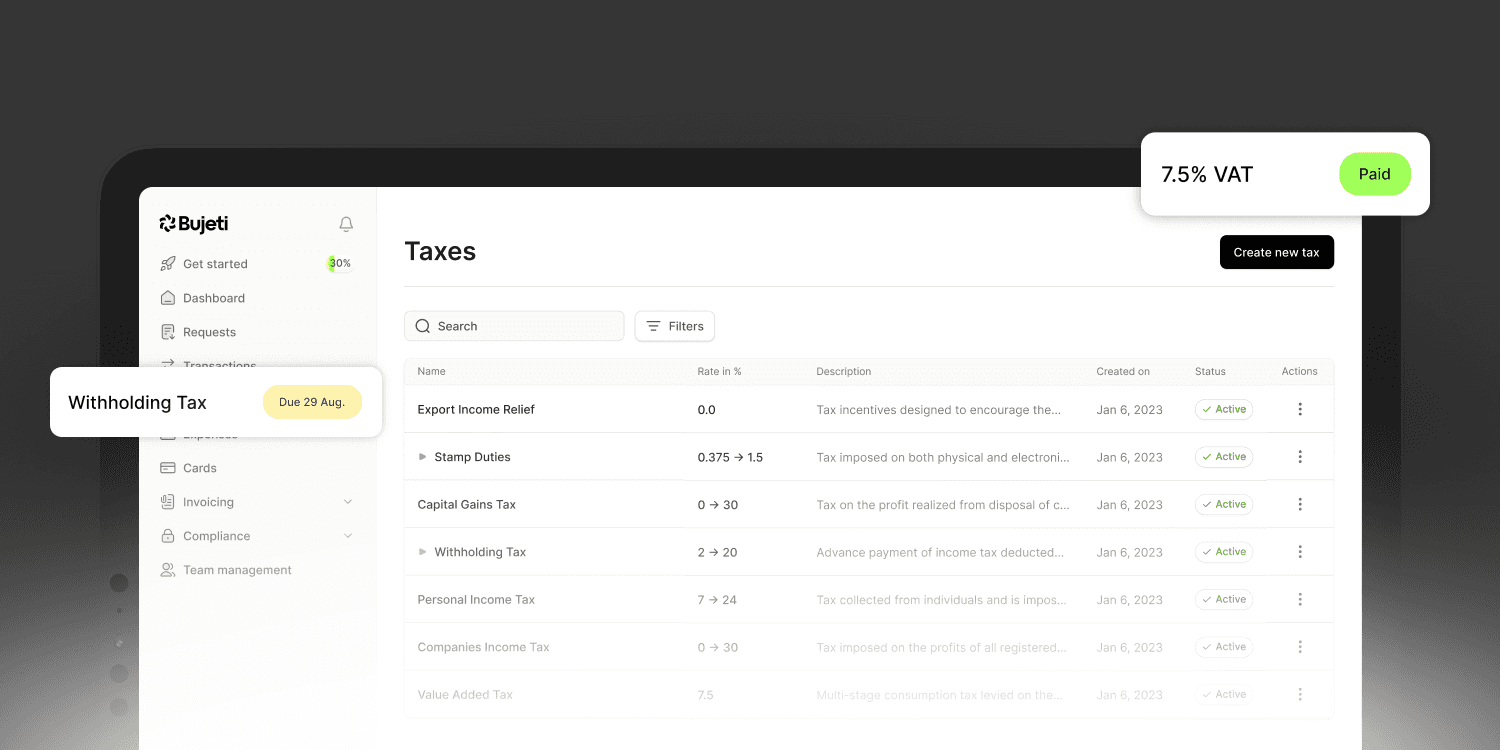

That’s why we’re rebranding Bujeti’s compliance module to something that better reflects how modern businesses should operate: Workflow. Because when compliance is built into your workflow, it doesn’t feel like a chore, it becomes a natural part of how your business runs, every single day.

What does compliance look like today?

For many teams, compliance still lives in spreadsheets and email chains. Maybe someone’s collecting receipts in a folder. Maybe finance is chasing managers for approvals at month-end. Maybe you’ve even had to apologize to a vendor because a payment got held up in the chaos.

Here’s what that kind of setup leads to:

Missed or lost documentation

Delayed payments and frustrated stakeholders

Unapproved or off-policy spending

Scrambles during audits

And worst of all, risk. Risk to your finances, your credibility, and your ability to grow.

The truth is, outdated compliance processes aren’t just inefficient, they can also cost you real money and real opportunities.

The shift from static rules to dynamic workflows

The old way says: “Here are the rules. Try your best to follow them.”

The new way says: “We’ve built the rules into your daily tasks, so everything just flows.”

With dynamic workflows, compliance doesn’t rely on people remembering policies or checking every detail manually. Instead, it’s built into the system. These include:

Approvals route automatically based on the spend amount or project.

Vendor payments can’t go through unless they meet predefined criteria.

Budgets have real-time alerts to prevent overspending before it happens.

With compliance workflow, you get no gray areas, Just clean, automated compliance baked into your day-to-day operations.

Benefits of workflow-based compliance with Bujeti

By renaming and reimagining our compliance module as Workflow, we’re putting focus where it belongs: on facilitating your operations, not policing them. Here’s what that unlocks:

Real-time policy enforcement

Every request is instantly checked against your set rules, so nothing unauthorized slips through.

Audit-ready records

All actions like approvals, edits, and rejections are logged with full visibility and timestamps. No more hunting for who did what.

Empowered teams

Give your team the freedom to act fast, with clear boundaries that keep them on track and aligned with policy.

Reduced risk

Automated workflows mean fewer errors, fewer oversights, and fewer awkward “we missed that” moments.

It’s not just about control. It’s about smarter, smoother collaboration.

Use cases: Where compliance meets workflow

Here’s how teams are already using Bujeti’s Workflow module to level up their operations:

Expense approvals

Instead of passing paper around or chasing signatures, requests are routed instantly to the right person based on amount, department, or role.

Vendor payments

Only verified vendors are eligible for payment, and any exceptions are automatically flagged—so you stay protected from fraud or off-policy spend.

Budget control

Teams can’t blow past their limits without warning. Bujeti will either block the transaction or trigger an alert—no awkward conversations needed.

These aren’t just features. They’re fail-safes that protect your business while making day-to-day work easier.

How to build your first workflow in Bujeti

Want to make the switch? Here’s a simple roadmap:

Step 1: Define your policy rules

Map out your internal policies—who can approve what, spend limits, vendor rules, and budget thresholds.

Step 2: Set up automated approvals

Use Bujeti to create routing rules for every kind of request. For example: expenses under ₦100,000? Auto-approve. Over ₦1,000,000? Route to Finance Director.

Step 3: Assign roles and permissions

Make sure each team member only sees what they need, and can only act within their scope.

Step 4: Monitor reports and refine

Use Bujeti’s built-in reports to spot patterns, improve policies, and stay two steps ahead as you scale.

With workflow, you'll be getting a self-sustaining system that keeps you compliant without the constant manual oversight.

Get workflow that works as you work

Compliance shouldn’t be a hurdle you jump over. It should be the solid, stable, and supportive ground you walk on.

By shifting from static rules to live, dynamic workflows, you transform compliance from a burden into a business advantage. You give your team the freedom to move fast within rails that keep you protected.

You get clarity. You get control. You get peace of mind, all without slowing anyone down.

So yes, we’re saying goodbye to “Compliance” and hello to Workflow.

Because real progress happens when the rules are working with you, not against you.