Is Corporate Card Fraud Bleeding Your Business Dry? Let’s Talk.

Tracy-Allen

June 20, 2025

Let’s be real for a second nothing drains businesses faster than corporate card fraud. It sneaks in, racks up charges, and before you know it, your company’s bleeding money, credibility, and time. Whether you’re running a startup or a full-blown enterprise, ignoring it is like handing your wallet to a stranger and saying, “Be gentle.” Spoiler alert: they won’t be.

In this guide, we’re unpacking what corporate card fraud really looks like, how it hits where it hurts (your bottom line), the red flags you should never ignore, and most importantly — how to shut it down before it spreads.

So, what exactly is corporate card fraud?

In plain terms: it’s any sneaky, shady, or straight-up illegal use of your company-issued cards. Think employees buying Yeezys on the company dime, padding expense reports, or scammers using your card like they own it. Sometimes, it’s inside jobs. Sometimes, it’s hackers. Either way, it’s costing you.

Why should you care? (besides the obvious)

Here’s the thing — this isn’t just about losing money. Fraud messes with your flow. It throws off budgets, delays projects, messes up audits, and leaves your team putting out fires instead of moving forward. Oh, and your reputation? It takes a hit too. Partners start asking questions. Clients start getting nervous. Trust gets shaky.

Let’s break it down:

You lose cash.

Your insurance premiums go up.

Cases of legal drama might spring up.

Chances of your business’s operations getting disrupted are high.

The sneaky ways fraud happens (so you can catch it faster)

You won’t always catch fraud red-handed. It’s more “death by a thousand swipes.” But some patterns pop up often:

Swiping for personal stuff like groceries or flights home.

Faking expenses — exaggerated meals, mystery vendors, or claiming the same Uber thrice.

Stolen identities — fraudsters posing as your employees or vendors.

Team-ups — when insiders and outsiders link up to pull off shady stuff.

Red flags you shouldn’t ignore

Catch these signs early and you could save your business thousands:

Random spending spikes or late-night charges.

Lots of tiny transactions just under your approval threshold.

Double-dipping — claiming similar expenses again and again.

Weird vendor names or unclear receipts.

Try to check whenever something feels off, it could be a fraud in play.

Set boundaries: Build a corporate card policy that slaps

If everyone’s playing by their own rules, fraud becomes a free-for-all. Here’s what a solid policy looks like:

Crystal-clear rules on what’s okay (and what’s definitely not).

Approval flows so no one's handing out cards easily.

Strict receipts and reports with a no-proof, no-reimbursement policy.

Checks and balances, and make sure to never let one person do it all.

Regular reviews so fraud doesn’t go unnoticed for months.

Real-world ways to prevent corporate card fraud

This isn’t about installing spy cams. It’s about smart systems and accountability. Here's how to keep things tight:

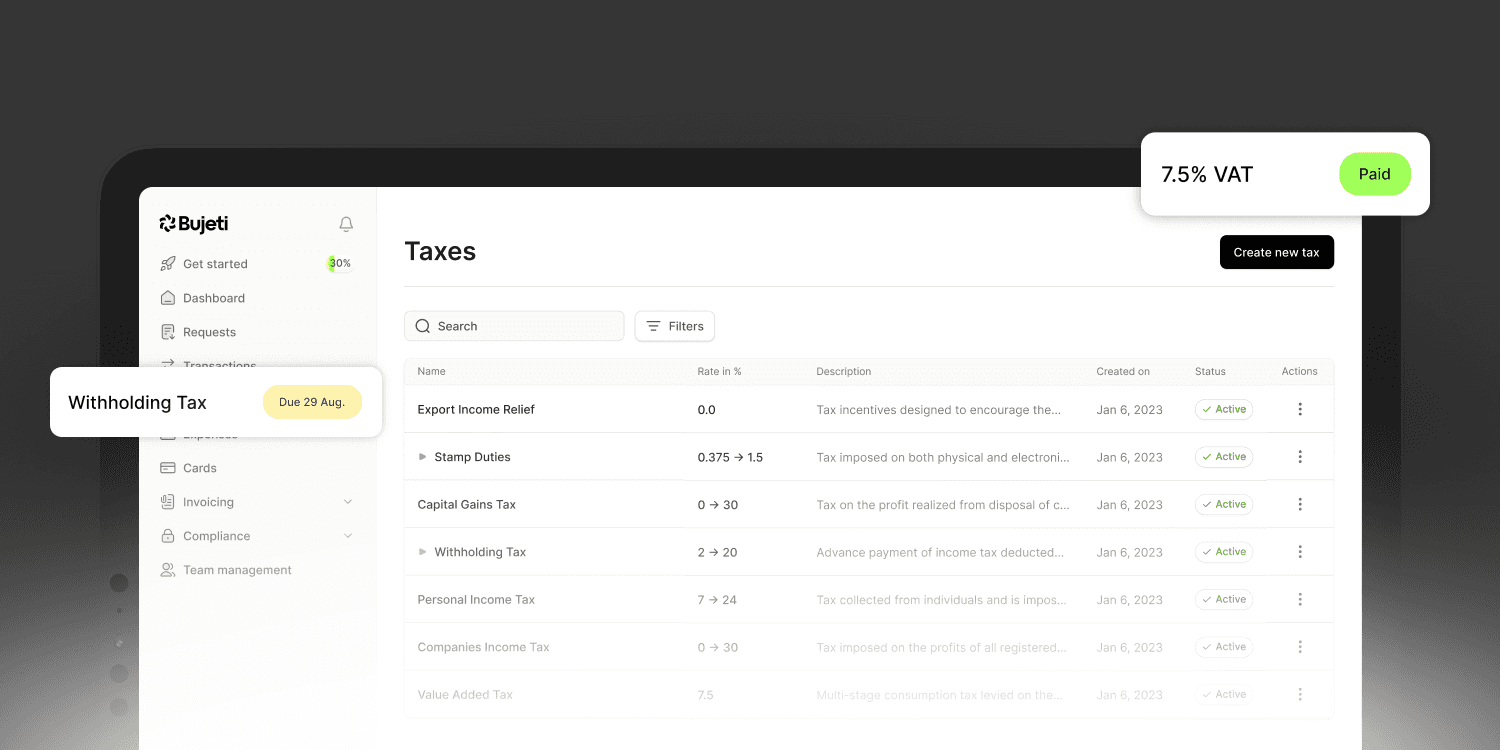

Get corporate cards from Bujeti.

Run random card audits.

Limit who gets a card cause really, not everyone needs one.

Use two-factor authentication for logins.

Keep passwords strong and updated.

Track transactions in real-time .

Train your team because people can't stop what they don’t understand.

Create safe spaces to report fraud.

Keep your policy fresh, cause fraud evolves and so should your rules.

Teach your team to stay sharp

Your people are your first line of defense, but only if they know what to look for. Make sure they:

Know the dos and don’ts of company card use.

Can spot shady activity (and speak up about it).

Understand how to keep data safe from hackers and phishers.

Get that fraud isn’t a “mistake,” it’s a problem that costs everyone.

Let tech do the heavy lifting

Manual tracking won’t cut it anymore. You need solutions that work as hard as you do:

Expense trackers with receipt uploads and auto-flags.

Fraud detection solutions powered by AI.

Spend analytics to show where your money's really going.

Mobile apps that let employees track and report, anytime.

Act fast when you think something’s off

Waiting it out only makes things worse. If you sense fraud:

Investigate quietly but thoroughly.

Loop in law enforcement if it’s serious.

Contact Bujeti to freeze your card account immediately.

Take action internally, and remember, no one’s above the policy.

Tighten up your systems so it never happens again.

Wrap-up: Protect your business, protect your bag

Corporate card fraud is real and out there But with the right solutions, tight policies, and a team that knows what’s up, you don’t have to fall victim.

Want a smarter way to manage your corporate spending?

Switch to Bujeti corporate cards. We’ve built-in security that does more than flag fraud, it prevents it. With Bujeti corporate cards solution, you can:

Set spend limits

Real-time tracking

Lock down who can use what, when, and where.

Visit Bujeti.com and take control before fraud takes from you.

Sign up now and start issuing cards with smart controls in minutes.