Why every business needs an expense management strategy?

Tracy-Allen

March 25, 2025

Benjamin Franklin, founding father of the United States, once said, “Beware of little expenses. A small leak will sink a great ship.” As inconsequential as it may sound, this financial advice could mar or grow your business.

Managing expenses is very crucial for individuals and businesses. Failing to track and control expenditures can lead to hidden costs that can seriously impact financial stability.

The ripple effect of unmanaged expenses

Unmanaged expenses can trigger a chain reaction of financial consequences, including:

Overspending and budget overruns

One of the most common consequences of unmanaged expenses is overspending. Without a proper expense tracking system, it’s easy to lose sight of your financial boundaries and overspend on unnecessary items, resulting in depleted funds, increased debt, and missed opportunities to save or invest in profitable endeavours. Moreover, budget overruns can lead to a strained cash flow and hinder growth potential.

Hence, it is crucial to establish a realistic budget to avoid overspending. Consider your income and financial goals, and prioritise your spending accordingly. Regularly track and compare your actual spending against the allocated budget to identify areas for improvement and adjust accordingly.

Inefficient resource allocation

Lack of expense tracking affects accurate resource allocation. Without a clear understanding of where your money is going, it becomes challenging to identify areas of excessive spending or inefficiencies. As a result, valuable resources may be wasted or misdirected, impacting overall productivity and profitability.

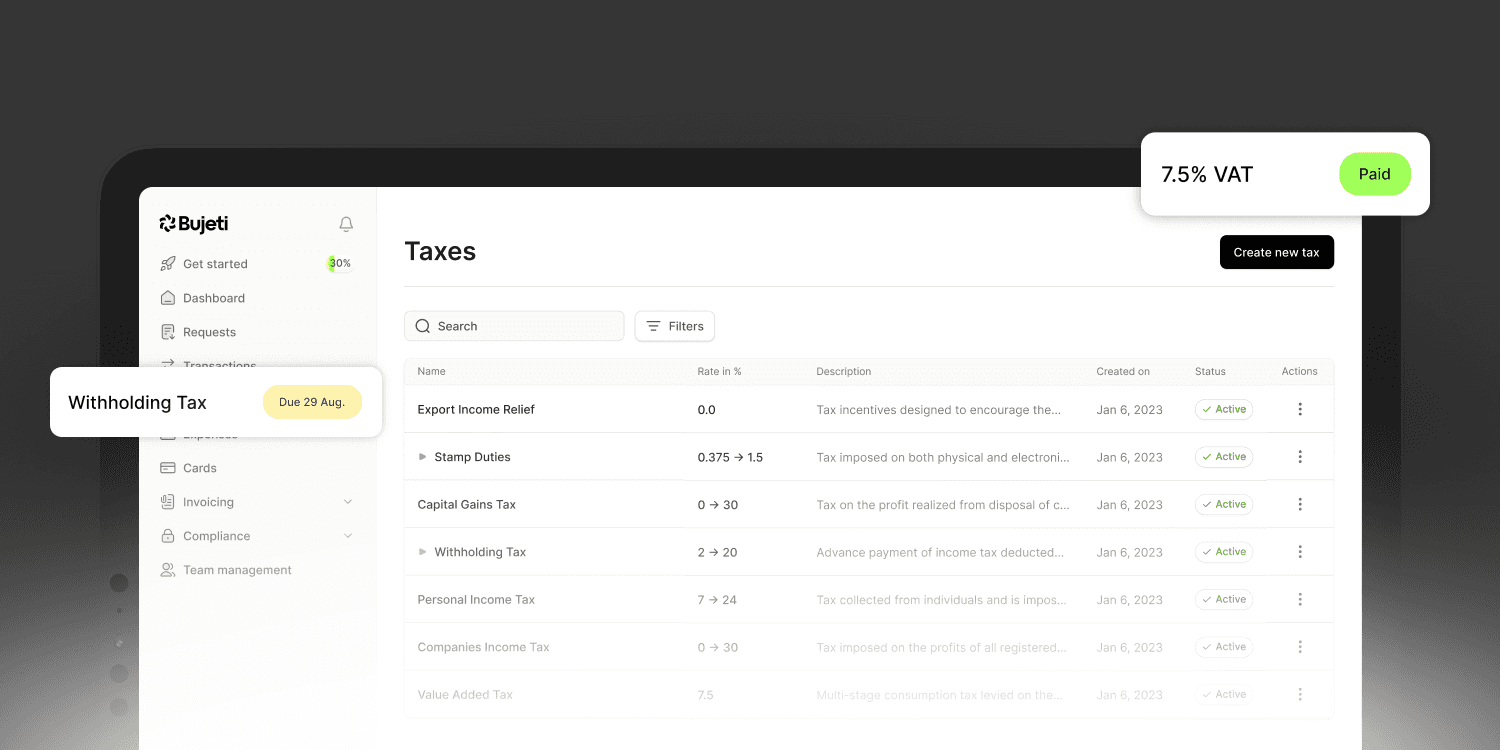

Implementing an effective expense management system like strict budgeting is vital to combat inefficient resource allocation. Bujeti, for example, offers features such as expense categorisation, receipt tracking, and real-time reporting. By leveraging such tools, you can better control your finances, identify spending patterns, and optimise resource allocation for maximum efficiency.

The dangers of inaccurate financial reporting

Unmanaged expenses can have far-reaching consequences on financial reporting accuracy and decision-making processes, like:

Tax penalties and compliance issues

Failing to account for expenses accurately can result in incorrect tax calculations, potentially leading to penalties or audits. Tax authorities require accurate records and documentation to ensure compliance. Without proper expense management, businesses may struggle to meet these requirements, leading to costly penalties and legal issues.

Adopting an expense management system like Bujeti enables you to maintain organised expense records, track deductible expenses, and generate accurate reports when filing taxes is time. This helps mitigate the risk of tax penalties, ensuring compliance with regulations.

Impaired financial analysis

Incomplete or inaccurate expense data undermines the ability to generate reliable financial reports and perform accurate financial analyses. This can have a profound impact on decision-making, hindering growth and profitability.

You may not understand your business’s financial health by failing to track and categorise expenses correctly. And without accurate financial analysis, it becomes challenging to identify areas of improvement, cost-saving opportunities, or investments that yield the highest returns.

Adopting an expense management system with comprehensive reporting capabilities is essential to overcoming these challenges. Bujeti, for instance, offers real-time reports, graphs, and charts that provide valuable insights into your spending habits, enabling you to make data-driven financial decisions.

Tips to avoid the hidden costs of unmanaged expenses

Now that we understand the potential consequences let’s explore some practical strategies for avoiding the hidden costs associated with unmanaged expenses.

Adopt an Expense Management System: Implementing a robust expense management system like Bujeti can revolutionise how you handle your expenses. Such tools provide a centralised platform to efficiently organise, track, and analyse your expenses. With Bujeti, you can easily capture receipts, categorise expenses, set spending limits, and generate detailed reports. By automating the expense management process, you save time, reduce errors, and gain better visibility into your financial landscape.

Set Realistic Budgets and Track Progress: Establishing realistic budgets is essential for effective expense management. Take the time to evaluate your income, fixed expenses, and financial goals. Set aside funds for essential needs, savings, and investments. With a clear budget, you can allocate funds wisely and avoid overspending. Regularly track and monitor your progress against the budget. Use expense management tools like Bujeti to categorise and analyse your spending patterns. By comparing actual expenses with budgeted amounts, you can identify areas where you exceed your limits and take corrective actions to stay on track.

Encourage Transparent Communication: If you’re managing expenses within a team or organisation, promoting open communication regarding spending is vital. Create a culture of transparency where employees feel comfortable reporting their expenses promptly and providing supporting documentation. This fosters accountability and helps maintain accurate financial records. Encourage team members to share cost-saving ideas and suggestions for improving expense management. Regularly communicate the importance of responsible spending and its impact on the overall financial health of the organisation.

Regular Review and Expenses Optimisation: Expense optimisation should be an ongoing process. Regularly review your expenses to identify areas of waste or inefficiency. Look for cost-saving opportunities such as negotiating better deals with suppliers, eliminating redundant subscriptions, or finding alternative suppliers offering better value. Leverage the reporting capabilities of your expense management tool to gain insights into spending trends. Analyse expense patterns over time and identify areas where adjustments can be made. You can free up funds for more strategic investments or savings by continuously optimising your expenses.

Conclusion

Unmanaged expenses can take a toll on your business’s financial well-being, leading to hidden costs detrimental to business growth. You can gain control over your expenses by implementing proper expense management practices and leveraging tools like Bujeti. Start here.